Welcome to Homeseed’s Summer Market Update for 2024! As we reach the halfway point of the year, it’s essential to reflect on the trends and developments that have shaped the mortgage market and housing industry thus far. The first six months of 2024 have been characterized by fluctuating mortgage rates, evolving economic conditions, and dynamic shifts in buyer behavior. Let’s dive into the key insights and projections that will guide us through the remainder of 2024.

Factors Influencing Mortgage Rates

- Federal Reserve:

- Controls short-term interest rates that indirectly impacting mortgage rates.

- As a general rule of thumb, rates rise in a strong economy and fall when the economy slows.

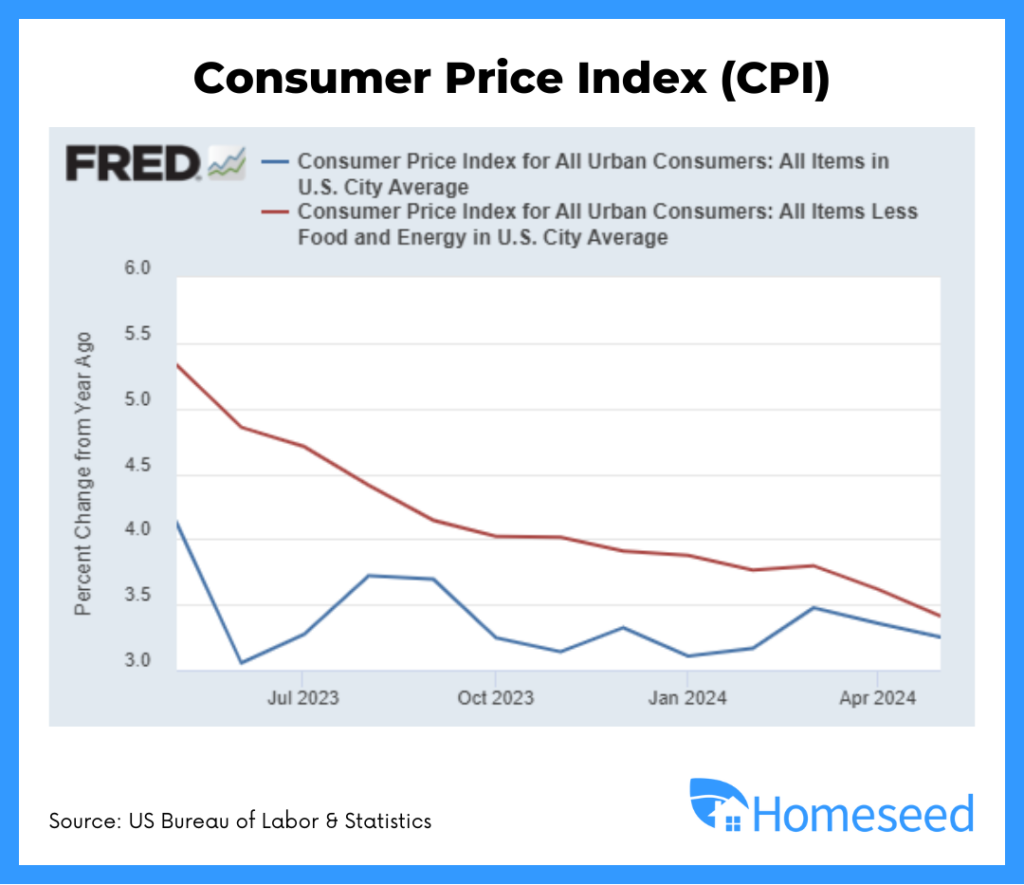

- Inflation:

- Bond Market: Inflation can reduce investor demand for mortgage-backed securities, which then causes bond prices to fall and mortgage rates to increase.

- Devaluation of Dollar: As inflation increases, the purchasing power of the dollar decreases, which can lead to higher prices for everything, including mortgage rates.

- Monthly Jobs Report:

- Strong employment and wages can put upward pressure on inflation.

- Weak employment data and rising unemployment will lead to rate cuts in an attempt to jumpstart the economy.

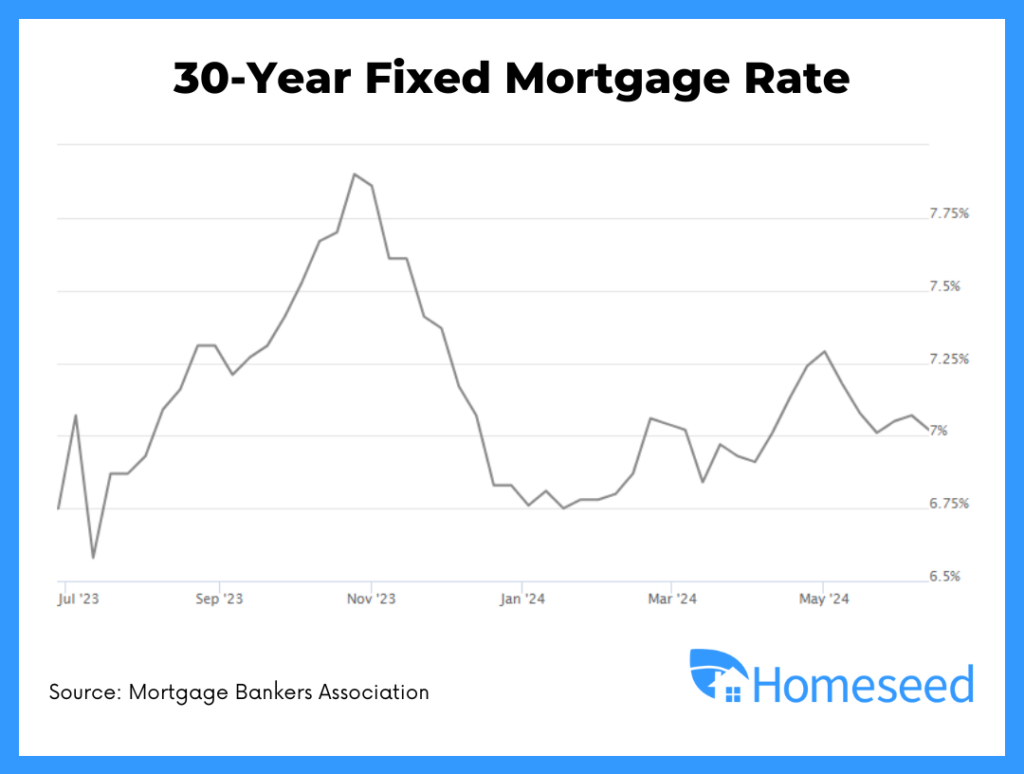

Mortgage Rate Outlook & Predictions

- Initial 2024 Predictions:

- Early 2024 predictions included three rate cuts by the Fed, which lead many experts in the industry to predict mortgage rates would fall in to the low 6% range by the end of the year.

- Concerns that the Fed would keep rates higher for longer began to arise in the first quarter of 2024 due to stalled progress on getting inflation towards their 2% goal.

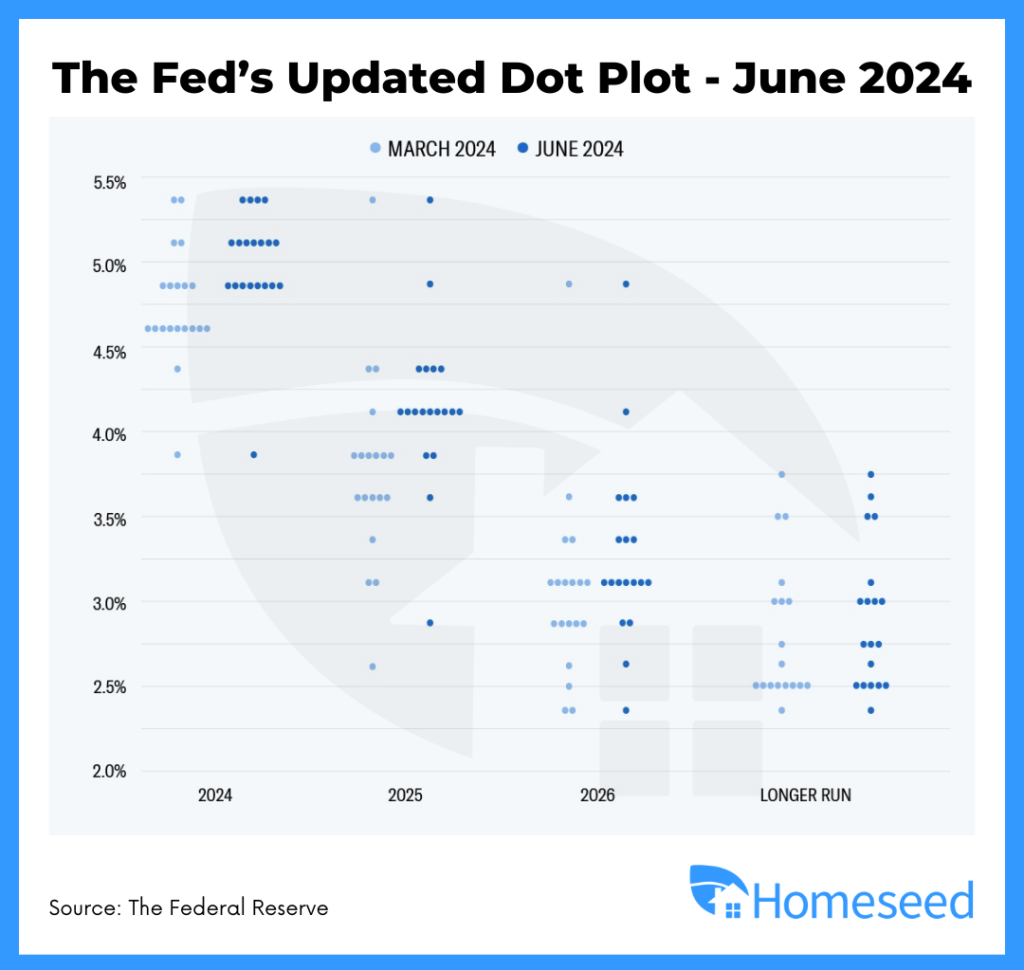

- Recent FOMC Meeting:

- Median expectation by Fed members now shows only one potential rate cut in 2024.

- Recent economic data has shown softening inflation and labor market, leading to lower rates over the past two months.

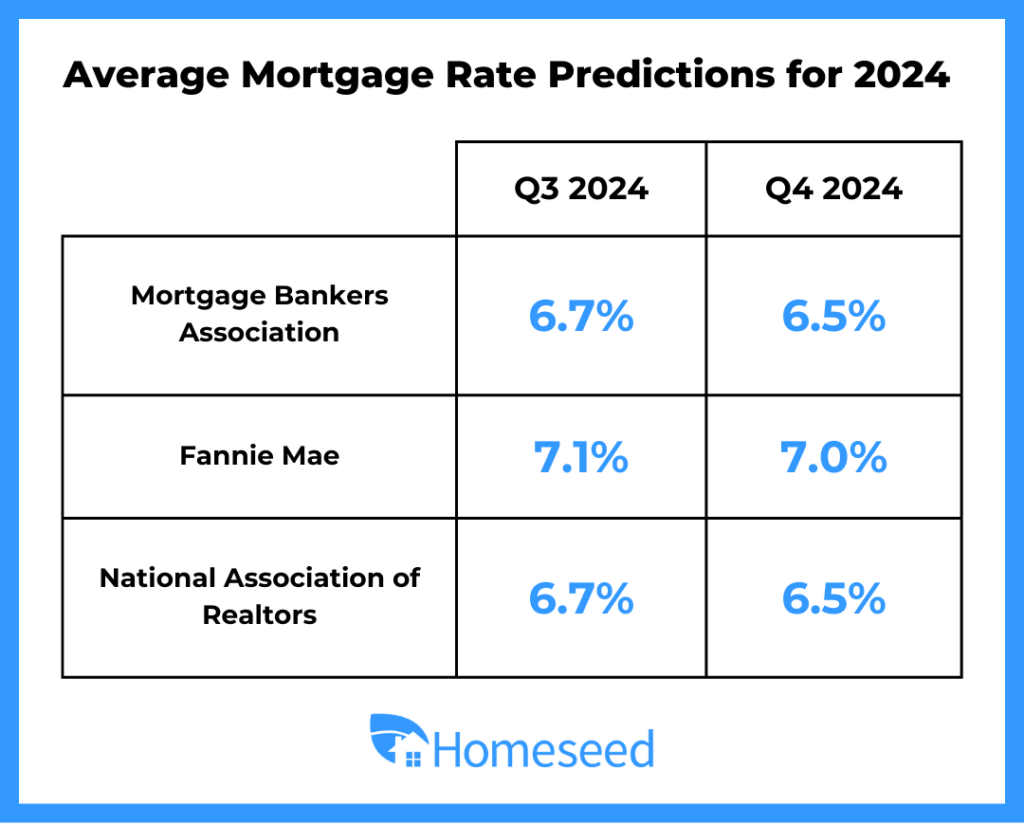

- Future Rate Trends:

- Most forecasts expect mortgage rates to fall slightly towards the end of 2024 to a range of 6.5% – 6.75%.

- Significant drops in inflation and rising unemployment could lead to faster rate decreases.

- Key reports influencing rates: BLS Jobs Report and Consumer Price Index (CPI).

- Chance of increased volatility in rates as we near the presidential election due to any potential uncertainty that may come about.

Housing Market Update

- Inventory and Supply:

- Inventory up nearly 35% from 2023, but still well below historical supply prior to the pandemic.

- Current inventory at 3.7 months’ supply compared to what is considered a balanced market at 6 months supply.

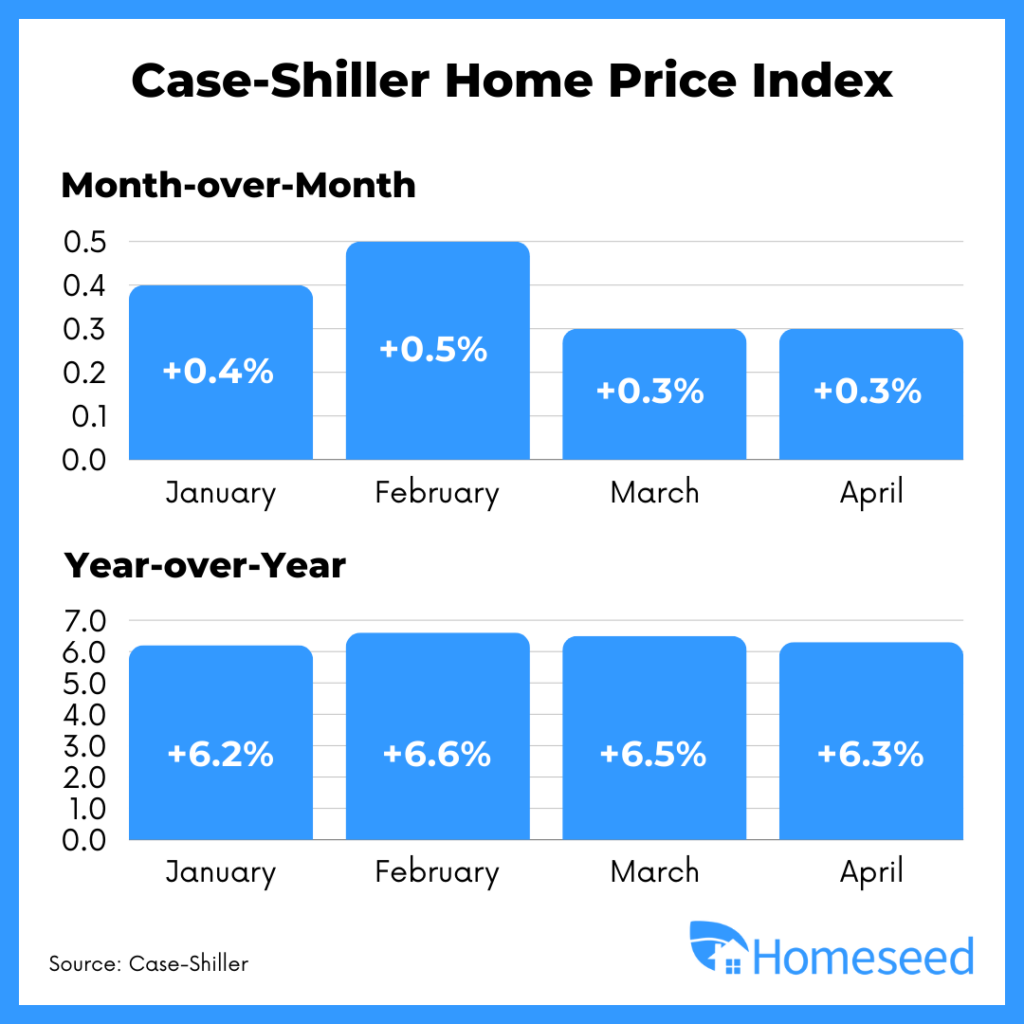

- Home Values & Demand:

- Home values will likely continue to increase through the end of 2024 as demand outweighs supply.

- Mortgage application volume for purchases have increased for three consecutive weeks and are at the highest level since January 2024.

Consumer Debt & Home Equity

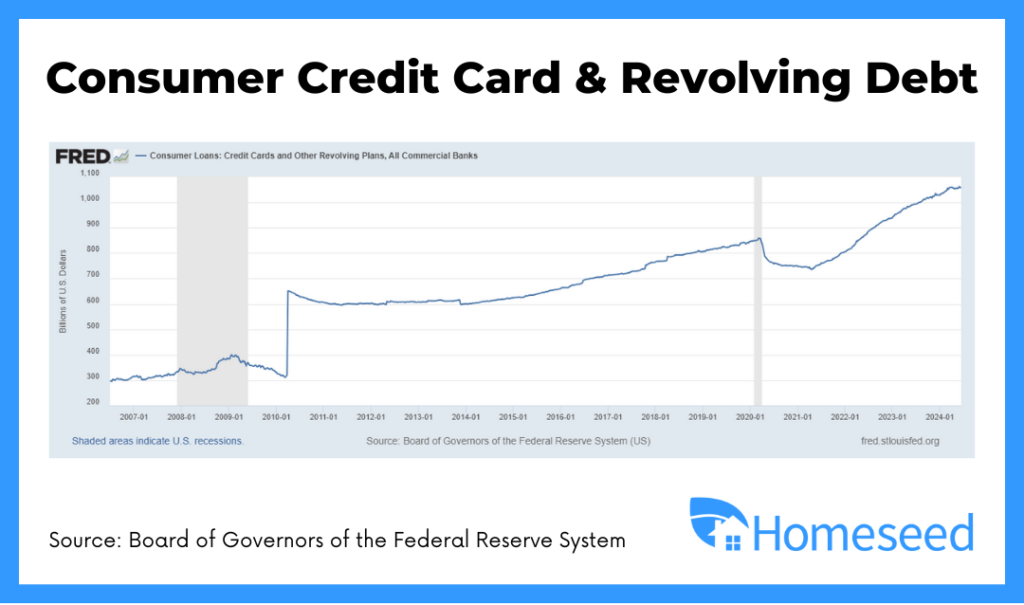

- Record High Consumer Debt:

- Consumer debt reached $1.15 trillion in Q1 2024.

- High credit card debt, rising charge-offs, and delinquencies suggest a potential slowdown in consumer spending.

- Impact on Economy:

- Reduced consumer spending could lower inflation and slow the economy, benefiting mortgage rates.

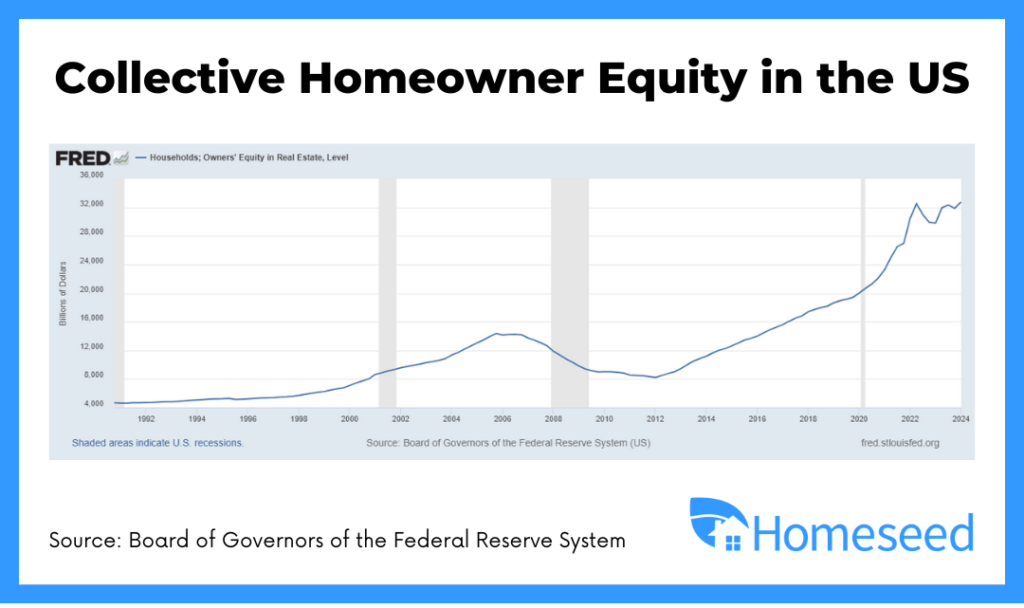

- Homeowners with high equity and debt could benefit from cash-out refinancing to improve cash flow.

Opportunities This Summer

The summer market is brimming with opportunities for both homeowners and homebuyers. With potential mortgage rate adjustments expected later this year, an estimated 5 million buyers could enter the market for every 1% drop in rates. Alongside the expanding inventory, this is the perfect time to stay informed and make strategic financial decisions. Whether you’re looking to upgrade your current home or start your homeownership journey, reach out today to explore the opportunities available this summer.